GET MENTORED BY CREDIT WITH KESHA

CREDIT REPAIR

WITH A TWIST

Credit Education

Learn how credit really works, how lenders think, and how to position yourself for approvals—not denials.

Credit Repair Strategy

Targeted dispute strategies to remove inaccurate, outdated, and unverifiable items—no guessing, just process.

Funding Readiness

We don’t just raise scores—we prepare your profile so banks say YES when it’s time to apply.

ARE YOUR READY FOR A TRANSFORMATION?

YOUR NEXT 6 MONTHS

A proven credit transformation roadmap designed to fix, rebuild, and position you for real approvals.

Removal of Negative Items

Identify and remove inaccurate, outdated, and unverifiable items through strategic disputes and compliance-based methods..

Personal Credit Rebuild

Rebuild your credit the right way with utilization planning, account structure, and lender-friendly scoring strategies.

Business Setup

Prepare your business profile for funding by aligning personal credit, business credit tiers, and lender requirements.

Business Funding Setup

Prepare your business profile for funding by aligning personal credit, business credit tiers, and lender requirements.

Credit Education

Learn how credit really works, how lenders evaluate risk, and how to avoid costly mistakes that slow approvals..

Funding Readiness

Get fully positioned for approvals with a complete funding-ready profile — not just a higher score.

PLANS FOR EVERYONE

CHOOSE YOUR MENTORSHIP PLAN

Every credit journey is different. Choose the plan that fits your goals and budget — all plans include personalized strategy and hands-on guidance.

$24.99 Credit Monitoring Required

Pay One Time

$499 One Time Fee

$24.99 Credit Monitoring Required

Pay in 2 Payments

$275 Every 2 Weeks

$24.99 Credit Monitoring Required

Pay Monthly

$199 for 3 Months

Get started for just $37 Today!

NOT READY YET?

DISPUTE AI

Dispute AI is essentially my strategy, simplified and accessible. It allows you to start taking action immediately using the same methods I use with my clients — and it seamlessly supports you if you choose full-service assistance later.

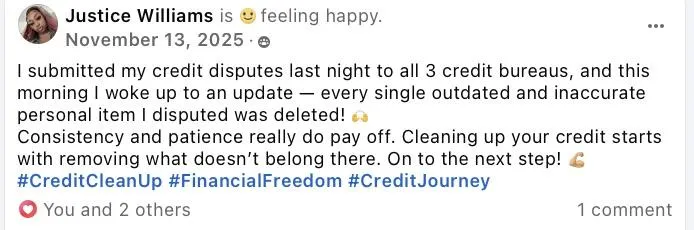

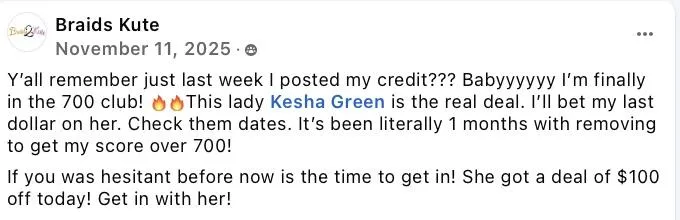

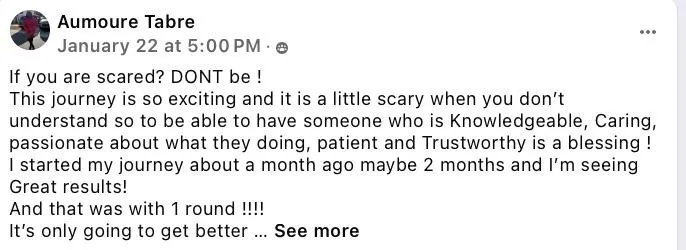

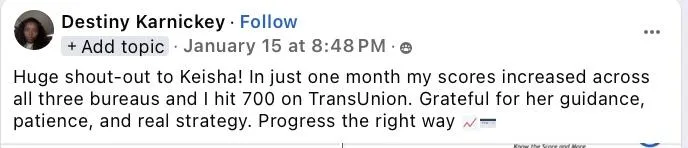

REAL RESULTS. REAL PEOPLE.

Client Success Stories

We believe the best proof is real results. Every testimonial you see here reflects a personalized strategy, consistent action, and guidance designed to move clients closer to approvals — not just higher scores.

From removing negative items to securing funding and rebuilding confidence, these stories show what’s possible when credit is handled the right way

Meet Sharmoen

Meet Tamara

I DONT CALL MYSELF THE GOAT

BUT MY CLIENTS DO

Real results. Real transformations. Hear directly from clients who trusted the process and took control of their credit.

PLANS FOR EVERYONE

CHOOSE YOUR MENTORSHIP PLAN

Every credit journey is different. Choose the plan that fits your goals and budget — all plans include personalized strategy and hands-on guidance.

$24.99 Credit Monitoring Required

Pay One Time

$499 One Time Fee

$24.99 Credit Monitoring Required

Pay in 2 Payments

$275 Every 2 Weeks

$24.99 Credit Monitoring Required

Pay Monthly

$199 for 3 Months

GET EVERY ANSWERS FROM HERE.

What services do you offer?

I provide strategic credit repair, credit education, and funding readiness support. This includes removing inaccurate or unverifiable items, rebuilding personal credit, setting up business credit properly, and preparing clients for personal and business funding.

How long does the credit repair process take?

Restoring your credit profile is not instant. Results vary based on your credit profile, creditor responses, and participation. Most clients see progress within the first 30–60 days, with continued improvements over the course of the program.

Do you guarantee results?

No credit repair company can legally guarantee results. However, I use proven, compliance-based strategies and personalized plans designed to give you the strongest possible outcome.

Will this hurt my credit score?

No. When done correctly, credit repair does not hurt your score. In many cases, scores improve as inaccurate and negative items are removed and positive habits are implemented. However, at the beginning your score will fluctuate.

Do I need credit monitoring?

Yes. Credit monitoring is required so we can accurately track changes, identify issues, and take action quickly. This also ensures transparency throughout the process.

Copyright © 2026 Credit With Kesha | All Rights Reserved.